[sharelines]Private companies are willing to invest in infrastructure and work with the public to do so.

The gap between needed highway-construction funds and gasoline-tax revenues threatens to widen further. Hybrid vehicles are a reality; alternative fuels are on the horizon; and the gasoline tax—long the workhorse of highway finance in the United States—will inevitably decline in importance. So the search is on for new funds. Can the private sector help fill the gap?

Only a few privately financed highways have been built in the US in the past half century. Among them, California’s State Route 91 (SR 91) in Orange County stands out as one of the mature examples. It began as something of a public policy long shot. In 1989, when state legislators debated a bill to allow a limited number of private highway franchises, even the bill’s supporters doubted it had a real chance of passage.

The Democrat-controlled state legislature favored expanding the gasoline tax instead. A transportation summit that convened leaders from both parties in the legislative and executive branches settled on a compromise that included a nine-cent gas-tax increase and allowed up to four private highway demonstration projects.

Rather than designate specific projects or routes as potential private franchises, the legislation encouraged private enterprisers to be innovative. Profits from the franchises would be capped at predetermined rates of return, but otherwise private entities were to enjoy broad leeway to locate, finance, and operate their roads as they saw fit. Toll rates, in particular, were not regulated except as would be required by limits on the rate of return. Private highway projects had to conform to the usual elements of state law that pertained to public highways, such as environmental clearance, but otherwise the private sector was allowed latitude to innovate in project specification, design, financing, and operation.

Rather than designate specific projects or routes as potential private franchises, the legislation encouraged private enterprisers to be innovative. Profits from the franchises would be capped at predetermined rates of return, but otherwise private entities were to enjoy broad leeway to locate, finance, and operate their roads as they saw fit. Toll rates, in particular, were not regulated except as would be required by limits on the rate of return. Private highway projects had to conform to the usual elements of state law that pertained to public highways, such as environmental clearance, but otherwise the private sector was allowed latitude to innovate in project specification, design, financing, and operation.

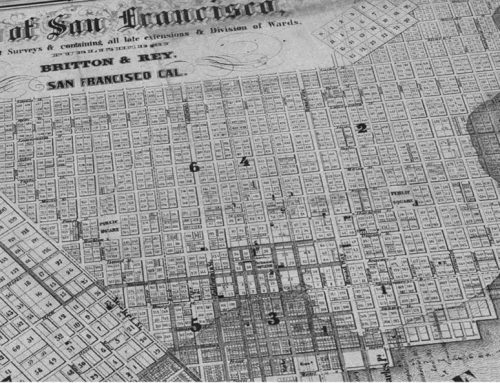

SR 91 surfaced early as a prime candidate for private franchising. The Orange County Transportation Authority (OCTA) had planned to build high-occupancy vehicle lanes (carpool or HOV lanes) in the median of the existing highway connecting the fast-growing suburbs of Riverside County to job centers in Orange County. But funds for the project were not available from traditional public-sector sources, so Orange County transportation officials were receptive to private-sector interest in the project. The California Private Transportation Company (CPTC), a limited partnership formed by subsidiaries of several corporations involved in highway construction, proposed private toll lanes for the median of SR 91. A 35-year franchise was approved in 1990, and the privately owned facility opened on December 27, 1995. The ten-mile-long toll lanes paralleled the most heavily congested portion of the approximately thirty-mile-long corridor from Riverside into northern Orange County.

The SR 91 toll lanes were innovative in several respects. They were the first US implementation of peak/off-peak road pricing (often called congestion pricing). The lanes have no toll booths; all tolls are collected electronically. While detailed financial information on the privately held CPTC has not been released to the public, experts generally agree that toll revenues likely met the private firm’s expectations. In the third year of operation (1998), the CPTC’s annual report noted that toll revenues covered all operating costs and all debt service except a subordinated loan which did not have to be paid in the near-term and which was less than ten percent of the project cost.

Shifting Public Perception

In the first few years after SR 91 opened, the lanes were viewed by many as a net public benefit. Early public opinion polls showed a majority of SR 91 drivers supported the peak/off-peak pricing scheme. A study conducted by Edward Sullivan at California Polytechnic State University in San Luis Obispo showed dramatic reductions in peak-period travel times. Travel time for the eastbound afternoon peak trip on an 18-mile portion of SR 91 that included the toll lane corridor dropped from seventy minutes in June 1995 to just under thirty minutes in June 1996. Also, average peak-period travel speeds on the eastbound free lanes more than doubled as traffic diverted to the toll lanes.

Yet by the late 1990s the public mood regarding the toll road had shifted. The franchise agreement contained a “non-compete” clause that forbade public agencies from increasing highway capacity within a one-and-a-half-mile-wide corridor on either side of the toll lanes for the life of the franchise agreement. During franchise negotiations in 1990, the non-compete area was considered essential to providing CPTC some assurance that their investment would not be subject to unanticipated competition from future free highway projects. Such non-compete clauses were part of most discussions and much received wisdom about highway franchising at the time. In the late 1990s, the California Department of Transportation (Caltrans) wanted to add merging lanes between the free lanes on SR 91 and the newly completed Eastern Transportation Corridor, a separate toll road built by a public agency. Caltrans justified the need for the new lanes based in part on accident rates and a wish to improve safety. According to the franchise agreement, safety concerns could override the non-compete provision. Yet Caltrans’ safety analysis was disputed, and the safety claims and competing public and private interests were hotly debated. In the course of that debate public opinion turned against the toll lanes. What had once been viewed as a source of needed congestion relief was now viewed by many as contributing to congestion or, worse, unsafe conditions.

Yet by the late 1990s the public mood regarding the toll road had shifted. The franchise agreement contained a “non-compete” clause that forbade public agencies from increasing highway capacity within a one-and-a-half-mile-wide corridor on either side of the toll lanes for the life of the franchise agreement. During franchise negotiations in 1990, the non-compete area was considered essential to providing CPTC some assurance that their investment would not be subject to unanticipated competition from future free highway projects. Such non-compete clauses were part of most discussions and much received wisdom about highway franchising at the time. In the late 1990s, the California Department of Transportation (Caltrans) wanted to add merging lanes between the free lanes on SR 91 and the newly completed Eastern Transportation Corridor, a separate toll road built by a public agency. Caltrans justified the need for the new lanes based in part on accident rates and a wish to improve safety. According to the franchise agreement, safety concerns could override the non-compete provision. Yet Caltrans’ safety analysis was disputed, and the safety claims and competing public and private interests were hotly debated. In the course of that debate public opinion turned against the toll lanes. What had once been viewed as a source of needed congestion relief was now viewed by many as contributing to congestion or, worse, unsafe conditions.

The debate was resolved when OCTA purchased the toll lanes from CPTC in early 2003 (for $207.5 million dollars). The lanes are now operated by OCTA, which still charges peak/off-peak tolls. But the non-compete clause was eliminated, and the issue of public mobility competing with private profit-making interests has receded. What had been one of the nation’s most visible examples of a privately owned toll road is now owned and operated by a public agency.

Lessons For Private Highway Finance

The SR 91 experience, seen in the context of a decade of highway privatization worldwide, provides at least four lessons for transportation agencies looking for alternative sources of highway finance.

1. Private-sector funding may work, but only as part of a public-private highway financing partnership. SR 91 was possibly a best-case option for wholly owned private franchising. The corridor cuts through a canyon in the Santa Ana Mountains, and there are few if any good alternative routes between Riverside and Orange County. Traffic demand was high and congestion was severe. Because the lanes were built in the median of a public highway, right-of-way was owned by OCTA and could be leased to CPTC. (The lease price for the right-of-way was a dollar a year.) OCTA had obtained environmental clearance for carpool lanes before franchising discussions began, so at the outset the project had already cleared environmental approval hurdles, typically a source of substantial uncertainty in highway projects. The combination of high travel demand in a congested urban area with low right-of-way costs and minimal difficulties with environmental clearance is unlikely to happen in other projects. Most experts believe that other projects might face high right-of-way costs, uncertainty of public or environmental approval, and uncertainties of travel demand that would preclude an acceptable rate of return.

Instead of imagining that private financing will substitute for public financing, transportation officials should view private involvement as a supplemental source of investment. In such circumstances, public and private investment would be combined. Merged funds can narrow the gap for projects that are too expensive to build with limited public funds, but that are also too expensive or too risky for private investors. Sharing risk and reward between the public and private sectors will be complex, and balancing public and private interests will be more difficult than in purely private franchises. Yet the future of private involvement in highway finance in the United States almost certainly will be in the context of public-private partnerships, rather than in wholly private highway franchises.

2. Balancing public and private interests will be fundamental. The SR 91 franchise was eventually undone by conflicts between public-and private-sector interests. Such conflicts are probably inevitable, and transportation officials must become adept at balancing competing public and private interests. Yet such conflicts will be difficult to predict fully in advance.

The SR 91 franchise, when granted in 1990, had a 35-year term, typical of private toll road franchises. It is difficult to anticipate urban growth patterns, changing travel demand, shifting political winds, and technology changes over such a time period. While understanding future possibilities at the time of the initial franchise agreement is desirable, it is even more important to define what happens when unanticipated circumstances cause either the private participant or the public sector to question the continuing wisdom of the original agreement. In short, public-private franchise agreements should contain within them the terms of the contract’s “undoing” should such undoing become necessary.

One lesson is that strict non-compete clauses are too inflexible to balance public and private interests over a span of decades. Instead, public-private highway agreements must articulate methods for balancing competing and evolving interests. One tool that can help, but that has been rarely if ever used in the US highway sector, is least-present-value of revenue (LPVR) franchise bidding. The LPVR concept was developed through research conducted by Eduardo Engel, Ronald Fischer, and Alexander Galetovic. The idea is that highway franchises can be auctioned by allowing private entities to bid on the present value of the toll revenue stream they would collect over the life of the project. The bidder proposing the lowest present value of toll revenues, or LPVR, wins the franchise. The LPVR becomes, in effect, an estimate of the value of the franchise. If the parties wish to end the franchise, the LPVR provides a benchmark assessment of the fair value to the private entity. While we do not suggest that LPVR auctions be adopted in exactly that fashion in the US, the benefit of assessing franchise value at an initial stage can be useful should contract renegotiation become necessary. Public-private highway franchise agreements can adopt both LPVR methods and more general institutional designs that provide a basis for negotiating the end to or major modification of agreements if circumstances require that.

One lesson is that strict non-compete clauses are too inflexible to balance public and private interests over a span of decades. Instead, public-private highway agreements must articulate methods for balancing competing and evolving interests. One tool that can help, but that has been rarely if ever used in the US highway sector, is least-present-value of revenue (LPVR) franchise bidding. The LPVR concept was developed through research conducted by Eduardo Engel, Ronald Fischer, and Alexander Galetovic. The idea is that highway franchises can be auctioned by allowing private entities to bid on the present value of the toll revenue stream they would collect over the life of the project. The bidder proposing the lowest present value of toll revenues, or LPVR, wins the franchise. The LPVR becomes, in effect, an estimate of the value of the franchise. If the parties wish to end the franchise, the LPVR provides a benchmark assessment of the fair value to the private entity. While we do not suggest that LPVR auctions be adopted in exactly that fashion in the US, the benefit of assessing franchise value at an initial stage can be useful should contract renegotiation become necessary. Public-private highway franchise agreements can adopt both LPVR methods and more general institutional designs that provide a basis for negotiating the end to or major modification of agreements if circumstances require that.

3. The public sector must be institutionally strong. Some assume that private sector involvement can compensate for a weak public sector. In highway finance, nothing could be further from the truth. The complicated nature of public-private highway partnerships requires a well-trained, well-staffed, institutionally strong public-sector partner. Transportation agency employees will need new skills to be able to partner with private entities in complex highway finance projects. This includes skills in project finance, not traditionally at the forefront of the “pay-as-you-go” financing philosophy that has characterized the gasoline-tax era. Institutional design will also require careful thought. Several rules of thumb adapted from other regulatory environments should be examined. These include shielding regulators from direct political pressure, providing buffers that reduce the risk of industry capture, and balancing the need for commitment with the need for flexibility in the face of changing circumstances. The regulatory environment for public- private highway partnerships will be complex, and transportation agencies will have to learn from other fields, such as electricity and telecommunications, where similar complexities have been more common.

4. High-occupancy vehicle lanes (carpool lanes) provide an early opportunity to pioneer some public-private highway partnerships. Cash-strapped metropolitan transportation agencies will increasingly face difficulties funding needed highway projects. Proposed carpool lanes, typically adjacent to unpriced highway lanes, provide an opportunity to involve the private sector. Public cost sharing will often be needed to lower private investment to levels that allow profitability. The publicly provided right-of-way for the SR 91 toll lanes was one form of public cost-sharing. Yet public-sector officials should carefully consider what they get in return for sharing the cost. One benefit public-private partnerships can provide is expensive infrastructure that would not otherwise be viable, especially in urban areas where land and right-of-way are becoming increasingly costly. While such ideas go beyond carpool lanes, unfunded carpool lane proposals on existing public rights-of-way will likely be the first opportunities to explore these new partnerships.

Conclusions

Public-private highway partnerships have much to offer cash-strapped transportation agencies, and SR 91 provides lessons in both opportunities and pitfalls inherent in those projects. Private sector involvement may be of particular interest in periods when public sector economic conditions are uncertain yet growth is rampant. As gasoline tax revenues are increasingly stretched, agencies that innovate will be best able to meet the public’s demand for mobility.

Yet public-private highway partnerships will be complex, and transportation officials should be pragmatic while learning from the SR 91 experience. Non-compete clauses such as were used for SR 91 will continue to be controversial, especially in regions where highly motivated voters are forced either to pay the toll or use lanes with poor service even where government can improve service. Private sector involvement also brings the calculation and balancing of costs and benefits into the realm of hard-nosed financial analysis. This does not necessarily mean that environmental and social factors are ignored. Rather, it can mean that they are more rigorously quantified, allowing for better informed decisions on alternatives.

In many urban areas, public funds will prove insufficient for needed transportation improvements. If current highway finance trends continue, some future choices will be between involving the private sector or foregoing needed infrastructure projects. Of course the private sector will only be interested in helping finance highway projects to the extent that there are profit-making opportunities; yet experiences in other countries suggest that private interests are willing to invest in infrastructure. Such investments require difficult decisions about cost sharing and the division of risks and rewards between the public and private sectors.

Are transportation agencies ready to partner with the private sector? Unfortunately, the answer is often “no.” Agencies that have been construction managers will have to become regulators in a complex environment. This will require new skills, changes in agency culture, and a willingness to seek practical solutions in an often ideologically charged environment. State transportation departments should nurture officials who are schooled in the complex regulatory, financial, and legal skills that will be needed for public-private highway partnerships. The main lesson from the SR 91 project is that private sector involvement in highway finance is not simple or predictable; nevertheless public officials should plan now for the day when such involvement can provide revenue that would otherwise not be available for needed infrastructure projects.