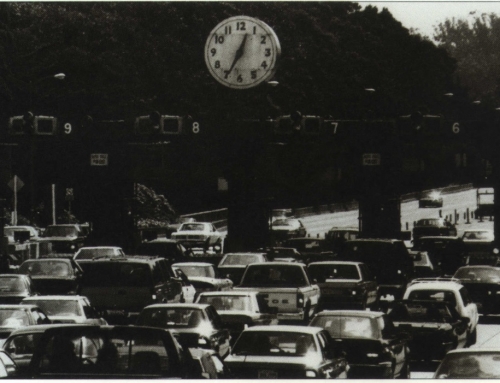

Whether you’re driving to work, to a doctor’s appointment, or to a dinner with a friend, you don’t want to reach your destination and then circle the neighborhood for 40 minutes looking for a parking space. You want even less to compete with dozens of other cars looking for that same vacant space, while dodging double-parked cars and listening to honking and cursing.

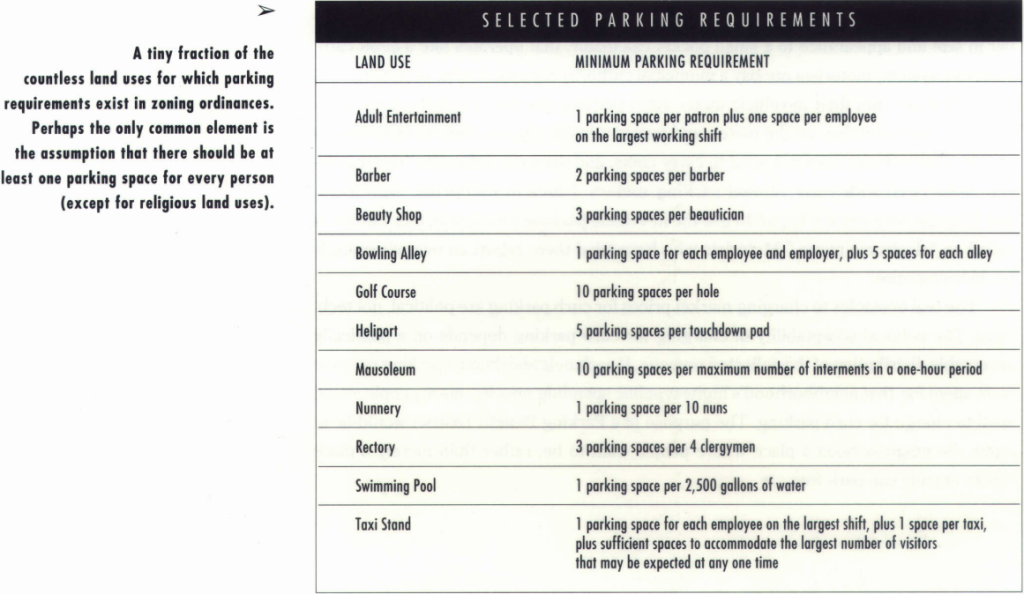

To prevent just that kind of nightmare, city planners across the country have ordained minimum off-street parking requirements for everything from apartment houses to zoos. They’ve thought that if the city could assure convenient, free parking, more visitors, employees, and business clients would come into town. Besides, by keeping parked cars off the streets, they could make local residents happy, and they’re the ones who vote.

B ut I believe that planners have seriously misdiagnosed the parking problem. By imposing minimum parking requirements, planners have inadvertently increased automobile dependency and decreased urban density.

ut I believe that planners have seriously misdiagnosed the parking problem. By imposing minimum parking requirements, planners have inadvertently increased automobile dependency and decreased urban density.

Because parking requirements are based on observing the number of cars parked at existing land uses, and because motorists report paying nothing to park for 99 percent of all trips,1 parking requirements are implicitly based on the demand observed at a zero price, without regard to either the cost of providing parking spaces or what motorists are willing to pay for them. When all development is required to provide enough parking to satisfy demand at a zero price, the resulting market price will be zero. The consequence is a vicious circle of parking subsidy, required oversupply of parking, and ubiquitous free parking which then leads to an observed “demand” that is used to set future minimum parking requirements.

But if new development doesn’t provide sufficient off-street parking to meet the newly created demand, won’t parking inevitably spill over onto the neighborhood streets? If nearby curb parking is free, any development that does not provide enough off-street parking to meet the demand at a zero price will cause spillover. I would argue that the spillover problem is not caused by a shortage of off-street parking for all motorists who want to park free. Rather, it is caused by the government’s failure to charge an appropriate price for curb parking.

If solving the spillover problem by pricing curb parking were so simple, why wasn’t it done long ago? The answer lies, I believe, with what happens to parking meter revenue. Money put into a parking meter seems literally to disappear into thin air. Unless citizens can see how the revenue directly benefits them, why would they support charging for something that used to be free?

To change the political calculus, suppose market prices for curb parking were introduced by creating “Parking Benefit Districts” that differ from existing Residential Parking Permit (RPP) districts in two ways. First, residents would continue to receive permits to park free in their district, but nonresidents would be charged the market price for parking. Second, the resulting revenue would be spent for additional public services in the neighborhood where the revenue is collected, such as for sidewalk and street repair, street tree planting and trimming, street cleaning, street lighting, graffiti removal, or putting overhead utility wires underground.

Spending curb parking revenue in the neighborhood where it is collected would help residents to see themselves as owners, not merely users, of curb parking. Seen from the resident’s side of the transaction, charging nonresidents for curb parking and spending the money to benefit the adjacent property resembles Monty Python’s scheme to “tax foreigners living abroad.”

A Parking Benefit District represents a compromise between the one extreme of free curb parking that is overused by nonresidents, and the opposite extreme of RPP districts that flatly prohibit nonresident parking. When cities establish conventional RPP districts, they are overlooking some important benefits that a more market-like solution can offer to both residents and nonresidents. A Parking Benefit District offers nonresidents the option of paying a fair market price to park (rather than simply prohibiting them from parking), and it offers residents neighborhood public revenue derived from nonresidents.

Almost every city must have some neighborhoods with broken sidewalks, potholed and treeless streets, or overhead wire blight that could benefit from additional public investment financed by nonresidents’ payments for curb parking.

Consider what it means to set a “market price” for curb parking. Traffic engineers usually recommend that at least one in seven curb spaces remain vacant at all times to ensure easy parking access and egress. Thus, the appropriate price for curb parking would limit demand so that at least one in seven spaces remains vacant to accommodate new arrivals. This strategy is not new: all commercial parking operators set prices high enough to maintain vacancies. The last thing a commercial operator ever wants to do is put out the “full” sign, because it means that the price is too low.

Can market-priced curb parking really yield sufficient revenue to make it worth collecting? At a price of fifty cents an hour for only eight hours each weekday, and an 85 percent occupancy rate, one parking space would yield $884 a year. By comparison, the median property tax on single-family houses was $922 a year in 1991. Many single-family neighborhoods have two curb spaces in front of each house. Therefore, even at modest market prices, potential curb parking revenue in neighborhoods subject to spillover parking could easily exceed current property tax revenue.

A neighborhood-generated public land rent that is spent on the neighborhood’s own highest public priorities should especially appeal to advocates of greater neighborhood self-government. It may not be easy to decide how to spend a Parking Benefit District’s revenue, but Special Assessment Districts, which are already used to finance public projects that specially benefit particular neighborhoods, show there is ample precedent for neighborhood political choice.

A neighborhood-generated public land rent that is spent on the neighborhood’s own highest public priorities should especially appeal to advocates of greater neighborhood self-government. It may not be easy to decide how to spend a Parking Benefit District’s revenue, but Special Assessment Districts, which are already used to finance public projects that specially benefit particular neighborhoods, show there is ample precedent for neighborhood political choice.

Special Assessment Districts are often organized by petition from residents, and it is common for each benefitted property to pay a special assessment in proportion to its street frontage. Indeed, the chief difference between a Special Assessment District and the proposed Parking Benefit District seems to lie in who pays: resident property owners pay special assessments, while nonresident motorists would pay for curb parking. Many cities already use special assessments, so these cities must already have the accounting systems for allocating district-specific revenue to neighborhood public services.

Because anyone parking illegally would be stealing neighborhood public revenues, residents would have a new incentive to cooperate with the police and parking enforcement officers in supporting parking regulations. And if market prices create ubiquitous vacant legal spaces, no one would ever “need” to park illegally by a fire hydrant, in a bus stop, or in a handicap space.

What’s more, we now have the technology to do away with having to feed the meter. One particularly promising new system employs a personal in-vehicle parking meter, similar in size and appearance to a small pocket calculator, that operates like a debit card. With this system, motorists pre-pay a municipal authority for a total value of parking that is programmed into their in-vehicle meter. After parking, the motorist keys in the parking zone code, switches on the meter, and leaves it inside the car with its LCD display visible. The motorist does not need to carry coins, and does not suffer the “meter anxiety” associated with conventional parking meters. Cities in California, New York, and Virginia have already begun to use the in-vehicle parking meter, which in Europe is called an “electronic purse.” Motorists who have tried them report an overwhelmingly positive response.

The real obstacles to charging market prices for curb parking are political, not technical. The political acceptability of charging for curb parking depends on a politically acceptable distribution of the collected revenue. If each neighborhood’s parking revenue were spent for that neighborhood’s highest public spending priority, more people would want to charge for curb parking. The purpose of a Parking Benefit District would be to make the neighborhood a place where people want to be, rather than merely a place where anyone can park free.

Is It Fair To Charge for Parking?

If people “need” parking, won’t pricing it necessarily harm the poor? But the fairness of charging for parking has to be considered in comparison to the alternative, which is “free” parking made possible by minimum parking requirements for all land uses. Parking itself appears to be free, but the cost does not disappear; rather, it reappears as higher costs for all other goods and services, especially housing. A case study from Oakland, California shows how minimum parking requirements reduce the supply and raise the cost of housing. In 1961, Oakland’s zoning ordinance began to require one offstreet parking space per dwelling unit for all apartments developed after that date. As a result, the number of dwelling units per acre in new developments fell by 30 percent and the construction cost per dwelling unit rose by 18 percent.

Why did developers reduce housing density by 30 percent in response to a minimum parking requirement of one parking space per dwelling unit? First, developers said the requirement made previous densities impossible without expensive underground garages; therefore, they reduced density and devoted more land to surface parking. Second, developers said that adding a dwelling unit required another parking space, but enlarging a dwelling unit did not; therefore, they built fewer but larger units.

All architects and developers know of similar situations where minimum parking requirements dictate what can be built, what it looks like, and what it costs. Form no longer follows function, or fashion, or even finance; instead, form follows parking requirements.

It is doubtful that “free” parking benefits the poor when the hidden costs of the consequent minimum parking requirements are considered. Because the cost of providing the required “free” parking is incorporated into the cost of all other goods and services, parking requirements force the poor to pay for parking regardless of whether or not they own a car. A recent transportation survey in Southern California found that the poorest 20 percent of the population owned only one car for every three persons, while the richest 20 percent owned one car for each person. In this environment, it would be misleading to argue that charging nonresidents for curb parking and reducing off-street parking requirements will harm poor people.

Will It Hurt Small Businesses?

A separate equity issue concerns the fairness of charging market prices for curb parking in areas where small businesses rely on curb parking for their customers. Recall that we want curb-parking prices to yield about an 85 percent occupancy rate. A lower price is called for if there are too many vacancies, and a higher price if there are so few vacancies that motorists must drive around to find a place to park.

Market pricing will not reduce the total number of curb spaces and will encourage a higher turnover rate. Also, those who arrive in higher occupancy vehicles can split any parking charge so their cost per person will be low, and those who stay a short time will pay little even if the price per hour is high. Because market pricing favors higher occupancy vehicles and higher turnover, adjacent businesses should end up with more customers per curb space than when the same spaces are free (and taken by solo drivers who stay longer once they find a spot).

Finally, by allocating the available curb spaces to those who are most willing to pay for them, rather than to those who will come only if parking is free, market-clearing parking prices should attract customers who will spend more in the adjacent businesses per hour they are parked. By delivering more, and higher-spending, customers per curb space, market prices should help rather than harm the adjacent businesses. The resulting revenue will also beavailable to spend on improving public services in the commercial districts where these businesses are located.

Conclusion

Comprehensive planning is supposed to coordinate individual actions toward a desired overall outcome, but what worthwhile planning goal is achieved by zoning ordinances that effectively remove the cost of parking as any disincentive to automobile ownership or use? Minimum parking requirements in zoning ordinances are like fertility drugs for cars, and they help to explain why the United States now has 1.1 motor vehicles per licensed driver.

When the whole city is considered the patient, minimum parking requirements will never cure traffic congestion, reduce air pollution, decrease energy consumption, or improve urban design. Rather, minimum parking requirements are a harmful addiction masquerading as a cure. When three spaces per 1,000 square feet no longer accommodate the demand for free parking, a stronger dose of four spaces per 1,000 square feet can temporarily quiet the neighbors’ complaints, but every jab of the parking needle relieves only the local symptoms, and ultimately worsens the real disease.

The fear of spillover parking is a legitimate but not unanswerable objection to eliminating minimum parking 25 requirements. To deal with spillover parking problems that may occur if cities eliminate parking requirements, I have proposed creating Parking Benefit Districts where the revenues from market-priced curb parking are dedicated to paying for neighborhood public services. At relatively modest parking prices, curb parking revenue could easily exceed the current residential property tax in neighborhoods subject to spillover parking from nearby commercial development.

Eliminating minimum parking requirements will encourage people to do what planners have long exhorted them to do: carpool, ride mass transit, bicycle, or walk. With market prices for curb parking, and a commitment to spend the resulting revenue to benefit the neighborhood where it is collected, spillover parking can become an important source of public revenue, rather than a source of annoyance. That is, spillover parking can be converted into an additional advantage of eliminating inappropriate minimum parking requirements.

Footnote:

- In the 1990 National personal Transportation Survey, the 48,400 respondents reported free parking for 90% of all their automobile trips.

References

Michael Cameron, ‘”Efficiency and Fairness on the Road” (Oakland, CA: Environmental Defense Fund, 1994).

Donald Shoup, ” Cashing Out Employer-Paid Parking: An Opportunity to Eliminate Minimum Parking Requirements?” forthcoming in Journal of the American Planning Association. UCTC No. 204.

Donald Shoup, Cashing Out Employer-Paid Parking, Report No. FTA-CA-11-003S-92-1 (Washington, D.C.: U.S. Department of Transportation, 1992). UCTC No. 140.

Wallace Smith, The Low-Rise Speculative Apartment, Research Report 2S (Berkeley: University of California Center for Real Estate and Urban Economics, 1964).

Richard Willson, Suburban Parking Economics and Policy: Case Studies of Office Worksites In Southern California, Report No. FTA-CA-11-0036-92-1 (Washington, D.C.: U.S. Department of Transportation, September 1992).